Limited by environmental

protection measurements, China’s glyphosate manufacturers were running on less

than half operation rate in 2017, reducing supply significantly. The beginning

of 2018 shows the beginning of a recovery, but the situation will likely remain

similar.

In

the year 2017, about 170,000 t/a of glyphosate capacity was suspended for

Chinese manufacturers. The reason can be found in Beijing’s fight against

environmental pollution and the resulting inspections of companies. Especially

heavily polluting industries, the one pesticides belong to, are at the centre

of China’s production suspensions for the greater good.

According

to market intelligence firm CCM, market insiders are predicting that the

challenges of the industry will go on in the new year, as environmental

protection measures will be even stricter in the future with no change of the

behaviour in sight.

Outlook for China's Glyphosate Market 2017-2021

With

new environmental inspections in China's major pesticide production regions,

the upward trend of glyphosate price has continued in the second half of 2017.

The traditional peak season for glyphosate as well as huge mergers in the

industry was supporting the development.

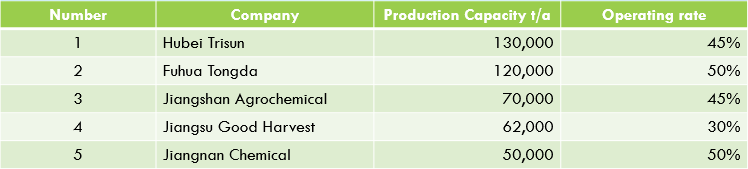

Top

5 glyphosate technical producers with production capacity in China, 2017

Source:

CCM

As

a matter of fact, increasingly stringent environmental measurements have quietly

become the norm in China’s pesticides industry. This has significantly

increased the production costs of agrochemical enterprises, and glyphosate TC

producers are no exception, according to CCM.

The

large enterprises are in the best position for 2018. Big glyphosate enterprises

have strengthened their efforts in response to environmental inspections,

including improving employees' environmental awareness, management mechanisms,

recycling technologies and the careful selection of factories.

Compared

to small- and medium-sized enterprises, large Chinese firms have multiple

advantages, laying mostly in finance and technology segments. The current

stringent environmental measurements are more beneficial for large enterprises

since they weaken the smaller competition and enable even larger market shares.

The

beginning of 2018 shows some sign that the production rate is beginning to

recover. In Jiangsu for example, the province just north of Shanghai, operating

rate of mainstream suppliers saw an uptrend in this month and market supply

increased slightly. It is worth noting, that some enterprises that suspended

production before had planned to resume production this month again.

Survey of Pesticide Industry in China

Furthermore,

when transactions remained flat, the supply of glyphosate technical was

relatively sufficient compared to the previous peak season. Looking at whole

China, 11 enterprises operated smoothly, including 3 in Central China, one in

North China, 5 in East China, 4 in Jiangsu Province, one in Zhejiang Province

and two in Southwest China.

Glyphosate

is the largest export commodity in China’s pesticide segment. For that, China's

glyphosate industry highly depends on the overseas market, exporting about 85%

of its output.

The

major export destinations of Chinese glyphosate technical are Argentina, the

USA, Brazil, Malaysia, and Indonesia while the major destinations of glyphosate

formulations are Thailand, Australia, Vietnam, the USA, and Ghana.

Global glyphosate

market

According

to industry insiders, the global glyphosate market is likely to exceed 6

billion by the next six years. Increasing high-quality food demand along

with the need to increase yield for feed production are the key

trending factors driving the glyphosate market. Increasing awareness for plant

growth enhancers to improve the farm yield will also support the market growth.

Policies for Pesticide Industry in China

In

the Asia-Pacific region, glyphosate is mostly used for crop protection of

maize, wheat, tea, sunflower, sorghum and cotton to enhance the crop yield of

farmers. Other potential application includes farming, parks, orchards,

vineyards and forestry. China glyphosate market is the largest worldwide and

its size was worth more than USD400 million in 2015, resulting out of the

increased food consumption by a growing middle class combined with limited

arable land availability, that farmers are trying to get the most yield out of.

The

global glyphosate market will grow around 5.3% CAGR up to 2024 with the

increasing application scope in genetically-modified crops. Rising preference

for treated genetically modified food to sustain food supply stability will

propel the product penetration.

About the article

The

information for this article is coming from CCM, China’s leading market intelligence

provider for the fields of chemicals, agriculture, food and feed.

For

any questions or inquiries, please contact our team at econtact@cnchemicals.com or

call us directly on 86-20-37616606.

Join the discussion in our LinkedIn or Facebook group to get in contact with your industry peers.

Follow us on Twitter: @CCM_Kcomber